do nonprofits pay taxes on investment income

This tax must be reported on Form 990-PF Return of. By not collecting these taxes more funds are able to be.

Why Should Nonprofits Consider Using An Operating Measure

Our reference tool explains UBTI Federal income taxes Donations Federal unemployment tax Taxes on financing and more.

. As long as a 501 c 3 corporation maintains its eligibility as a tax-exempt organization it will not have to pay tax on any profits. Even though the federal government awards federal tax-exempt status a state can require additional documentation to. UBI can be a difficult tax area to navigate for non-profits.

For tax years beginning after Dec. Below well detail two scenarios in which nonprofits pay tax on investment income. Answer 1 of 6.

A large percentage of 501 c 3 nonprofits are also exempt from. The tax rate on capital gains for most assets held for more than one year is 0 15 or 20. And it doesnt stop there.

This includes capital gain dividends received from a regulated investment company. Form 990-EZ which is a much shorter version of the main form is for nonprofits with gross receipts between 50000 and 200000. In a nutshell nonprofits can make up to 1000 of unrelated income before they have to pay taxes on it.

First and foremost they arent required to pay federal income taxes. In figuring the tax on net investment income a private foundation must include any capital gains and losses from the sale or other disposition of property held for investment purposes or for the production of income. Additionally nonprofits and churches are exempt from paying all property taxes.

Below is a beginners guide intended for high-level determination of whether rental income is subject to unrelated business income tax reporting for tax-exempt entities under Internal Revenue Code Section 501 c 3. When your nonprofit incurs debt to acquire an income-producing asset the portion of the income or gain thats debt-financed is generally UBTI. 20 2019 the excise tax is 139 of net investment income and there is no reduced 1 percent tax rate.

Although dividends interest rents annuities and other investment income generally are excluded when calculating a not-for-profits unrelated business income tax UBIT there are two exceptions. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. That said youll want to check your local rules in case they differ from federal ones.

Consulting fees account for 0119 percentage points and custodial fees 0053 percentage points. This guide is for you if you represent an organization that is. The full Form 990 is for non-profit organizations with gross receipts greater than or equal to 200000.

Answer 1 of 3. Investment management fees cost them 0542 percentage points. Your recognition as a 501 c 3 organization exempts you from federal income tax.

To be exempt from federal income tax the organization in addition to being non-profit has to meet a. Such assets are usually real estate but could also be stocks tangible personal property. There are many examples of this the auto club is one.

The previous answer related to non-profit charities. A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act. For tax years beginning on or before Dec.

An agricultural organization a board of trade or a chamber of commerce as described in paragraph 149 1 e of the Act. Yes nonprofits must pay federal and state payroll taxes. The research to determine whether or not sales tax is due lies with the nonprofit.

What Taxes Do Non-Profits Pay. While a qualified Non-Profit does not have to pay any taxes it still must file a Form 990 with the IRS every year. In most cases they wont owe income taxes at the state level either as long as they present their IRS letter of determination to the states Department of Revenue.

But nonprofits still have to pay employment taxes on behalf of their employees and withhold payroll taxes in accordance with the information submitted on their W4 just like any other employer. An example of a non-profit corporation may be an HOA or a condominium corporation. I will answer with respect to non-profit corporations.

In the USA an organization can be non-profit without being exempt from federal income tax. These fees total 0714 percentage points which may seem trivial but it is enough to reduce earnings by 18 percent over a 30-year period. This means the rental income investment income and many other forms of income that would be tax exempt for other organizations are not tax exempt for 501c7 9.

Generally the first 1000 of unrelated income is not taxed but the remainder is. Entities organized under Section 501 c 3 of the Internal Revenue Code are generally exempt from most forms of federal income tax which includes income and capital gains tax on stock dividends and gains on. The tax rate on capital gains for most assets held for more than one year is 0 15 or 20.

You use Form 990-T for your tax return. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. If it ends with the calendar year then the Form must be filed by May 15th.

This form is due on the 15th day of the 5th month following the end of the Non-Profits fiscal year. Up to 25 cash back While nonprofits can usually earn unrelated business income UBI without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate tax rules. There are clear rules as well as several exceptions to.

If a NFP fails to file this form three years in a. 5 A nonprofit can jeopardize its exempt status by earning too much income that is unrelated to its mission. 20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases.

If the nonprofit uses the real estate purely for its mission -- a historic society that owns historic buildings say -- theres no tax on the gains when the property is sold. Taxability of rental income is fact-and-circumstance driven so. But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky.

If the foundation sells or otherwise. These non-profits collect revenues that exceed their annual expenses which goes to. If the nonprofit uses the property for an unrelated business it pays tax as described in Form 598.

Even tax-exempt nonprofits sometimes earn taxable income. Capital gains taxes on most assets held for less than a year correspond to ordinary income tax rates. Then theres Form 990-N commonly known as an electronic postcard which is for nonprofits with gross.

Nonprofits and churches do not have to pay federal income tax nor do they have to pay any state or local income tax. Anything more will require the nonprofit to pay both state and federal corporate income taxes. But clearly defining what.

Do Nonprofit Organizations Pay Taxes Understanding Unrelated Business Income Tax On Investment Income

Non Profit Tax Exemptions Tax Exemption Non Profit Federal Income Tax

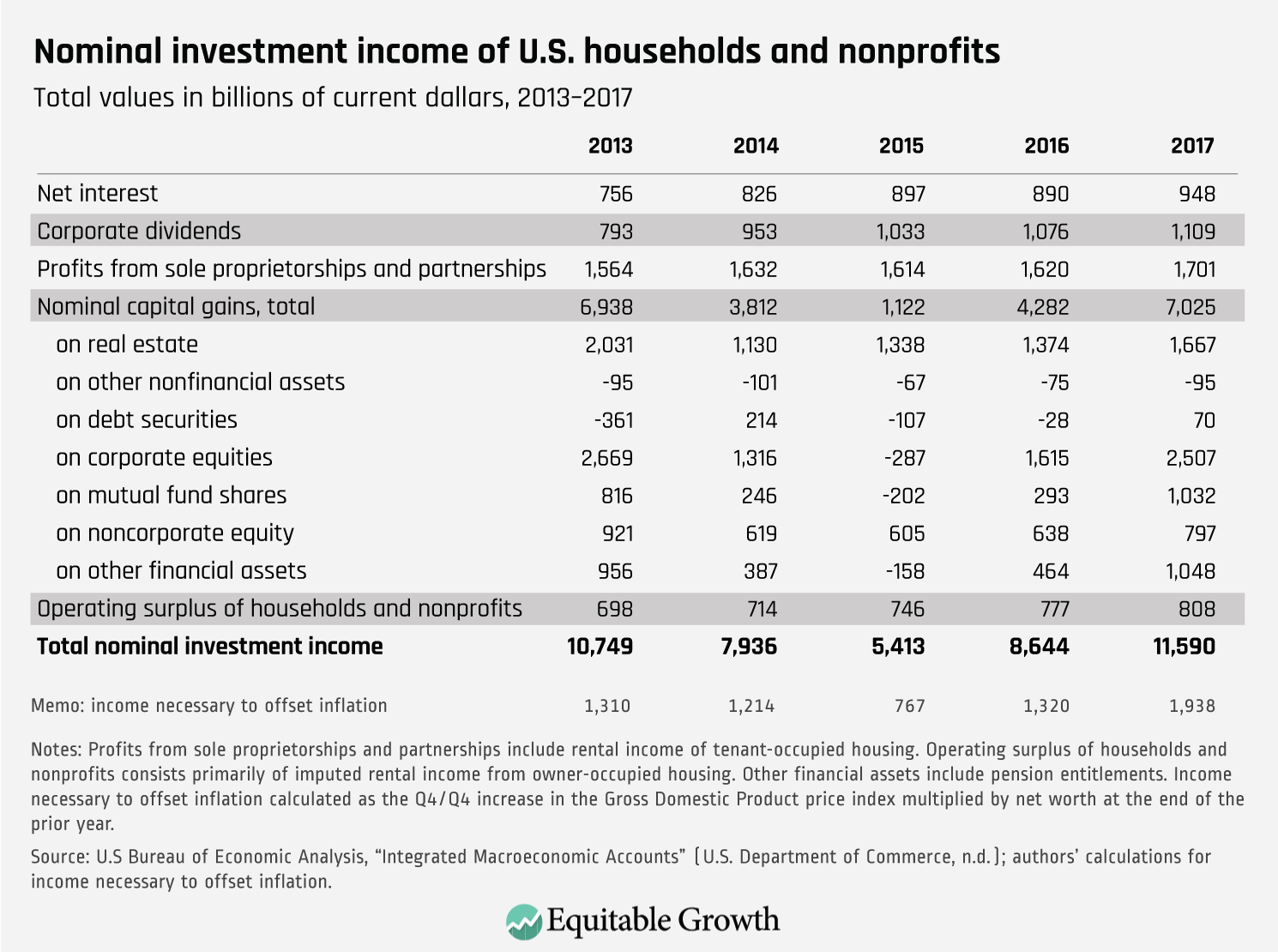

Nominal Investment Income Of U S Households And Nonprofits Equitable Growth

Reit Might Sound Intimidating At First But It S Really A Very Simple Concept Think Of It As A Mutual Fu Investing Money Strategy Investing Money

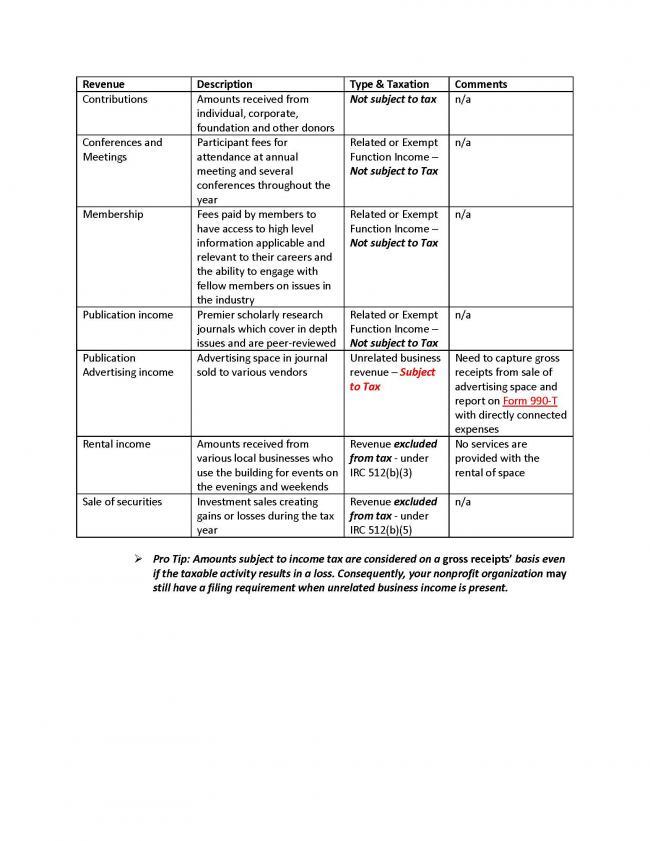

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

Why Should Nonprofits Consider Using An Operating Measure

Are 501c3 Stock Investment Profits Tax Exempt Turbotax Tax Tips Videos

A Guide To Investing For Non Profit Organizations Round Table Wealth

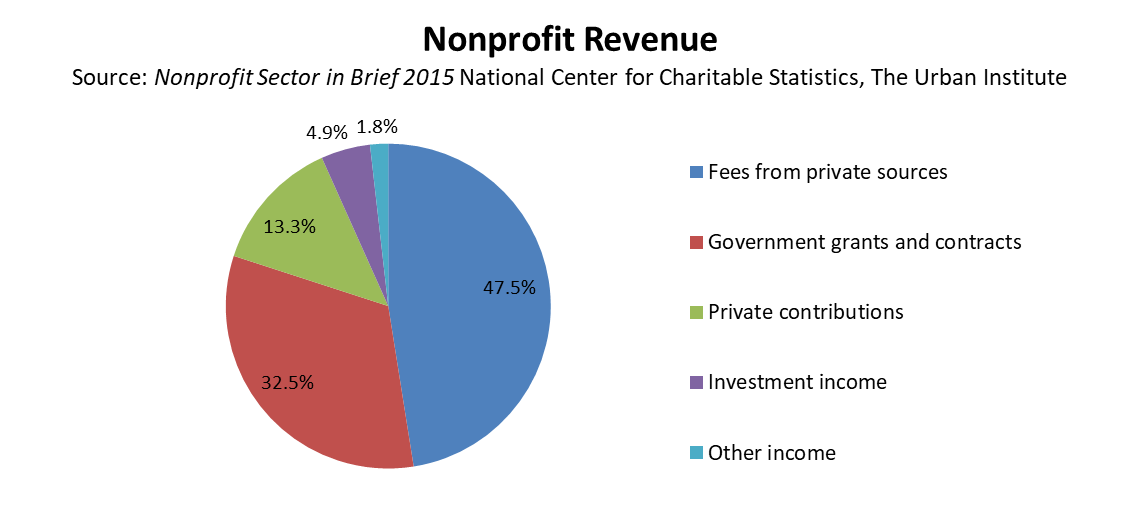

Nonprofit Income Streams An Introduction Nonprofit Accounting Academy

Investment Return Considerations For Nonprofits Implementing The New Financial Statement Presentation Framework Aafcpas

When Does Your Nonprofit Owe Ubit On Investment Income Marks Paneth

Legal Entity Options For Worker Cooperatives Grassroots Economic Organizing Worker Cooperative Economics Cooperation

When Does Your Nonprofit Owe Ubit On Investment Income Tonneson Co

Not For Profit Vs For Profit Harbor Compliance Social Enterprise Business Benefit Corporation Social Entrepreneurship

Event Sponsorship Infographic Template Event Marketing Plan Event Sponsorship Event Marketing

When You Need Your Taxes Done Right Help Is A Phone Call Away Location Does Not Matter We Prepare U S F Income Tax Tax Preparation Income Tax Preparation

Business Nonprofit Fundraising Ideas Capital Gains Tax Capital Gain Tax Credits

Private Foundations And The Excise Tax On Net Investment Income