tax avoidance vs tax evasion uk

Because there is a difference between tax evasion and tax evasion. The difference between tax avoidance and tax evasion essentially comes down to legality.

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

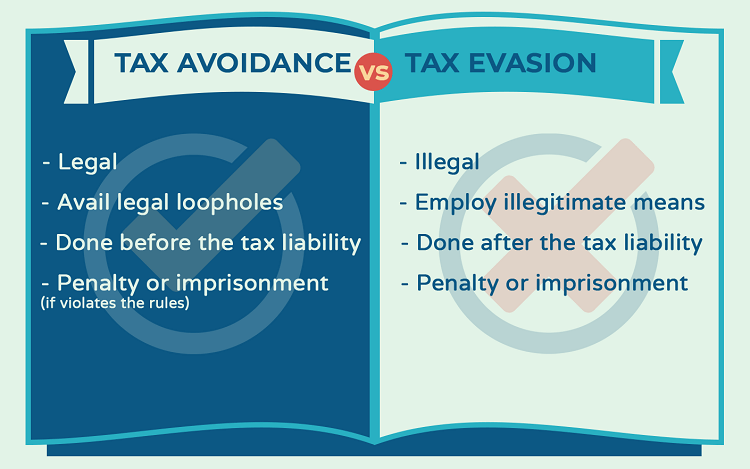

Tax avoidance means exploiting legal loopholes to avoid tax.

. Crossing that line can. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. HMRC has confirmed that it has generated billions.

Tax evasion means illegally hiding activities from HMRC to avoid tax. No one likes to pay taxes. Tax evasion means concealing income or information from tax authorities and its illegal.

Tax avoidance involves bending the rules of the tax system to try to gain a tax advantage that Parliament never intended. Tax avoidance may exist in a controversial area of the tax system but tax evasion most definitely doesnt. Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to.

One is illegal the other legal though arguably immoral on a larger scale. Tackling tax evasion and avoidance print file Ref. According to most recent official estimates tax avoidance in the UK costs the Exchequer about 18bn a year while tax evasion is believed to cost an eye-watering 53bn.

It is split into three chapters and. Tax avoidance and tax evasion. What is tax avoidance.

A tax avoidance scheme includes one or more interlinked steps which have no commercial purpose except for the avoidance of tax otherwise payable and can conveniently be described. HMRC defines Tax Evasion as Concealing of taxable income or the use of benefits to avoid the tax payment Tax. Tax avoidance is when the rules of the tax system are deliberately bent to gain an advantage that was never intended to be made available.

Tax evasion is ILLEGAL. However tax evasion is much different. What is tax evasion.

In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities. ISBN 9781474116787 9781474116787 Cm. It is estimated that in 201920 the.

Tax avoidance means legally reducing your taxable income. It often involves contrived artificial transactions. This policy paper sets out the governments approach and achievements in tackling tax avoidance evasion and other forms of non-compliance.

As the government states. 9047 PDF 122MB 32 pages. Contractors are free to use tax avoidance strategies to reduce their tax liabilities and depending on their appetite for risk this could range from investing in a pension to joining an.

Tax evasion is the deliberate non-payment of taxes that is illegal. The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the law. Its as simple as that.

Tax Evasion What is it. But taxes are the law. Avoiding tax is legal but it is easy for the former to become the latter.

Report tax fraud by a person or business to HMRC - tax evasion VAT fraud false claim for Coronavirus Job Retention Scheme Child Benefit or Tax Credit fraud.

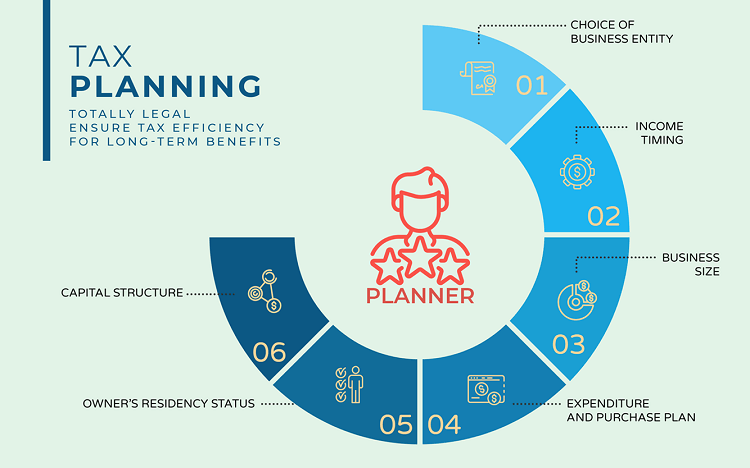

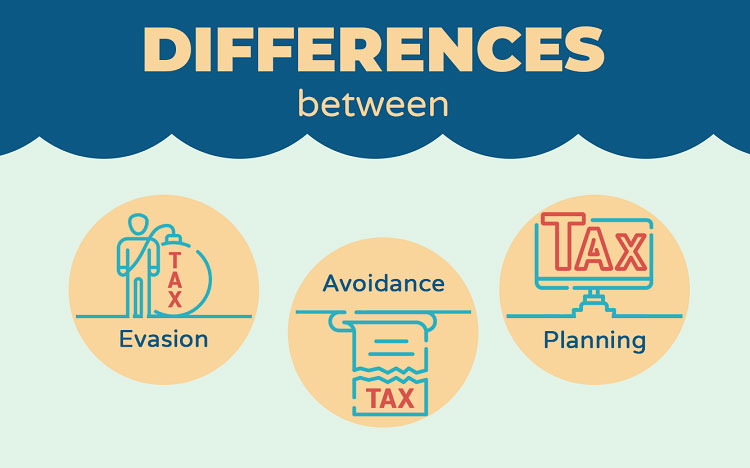

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion Vs Tax Avoidance 4 Rules You Should Follow Youtube

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

Income Tax And Ni Basics 2020 Income Tax Income Business Infographic

Tax Avoidance Vs Tax Evasion What S The Difference

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Benefits Fraud Vs Tax Evasion Cost To The British Taxpayer R Labouruk

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar

Your Thoughts Tax Avoidance Offshore Loopholes

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Tax Avoidance Is Not Tax Evasion But Try Telling Politicians Private Banking Asset Protection And Financial Freedom

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Tax Avoidance Tax Planning And Tax Evasion What S The Difference The Accountancy Partnership

Differences Between Tax Evasion Tax Avoidance And Tax Planning